Tax Sale Investing Blog

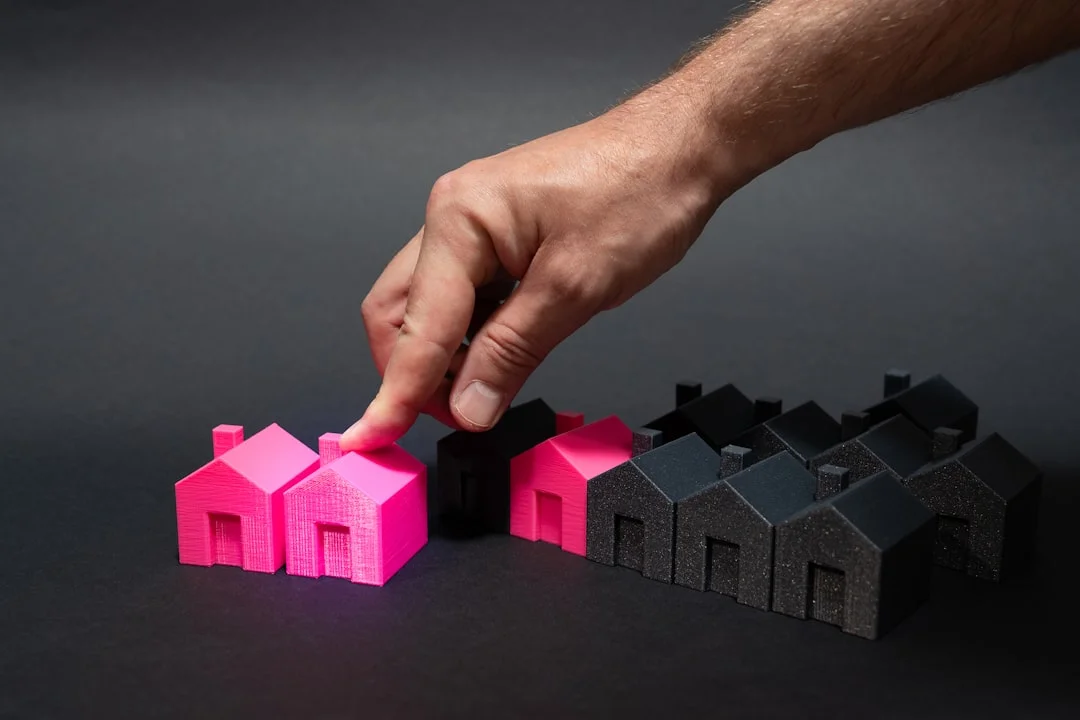

Expert insights, tips, and strategies for tax sale investing in Canada.

Latest Articles

Essential Financial Calculators for Tax Sale Investors in Canada: 2024 Update

Discover the financial calculators that can transform your tax sale investment strategy. From property valuation to profit estimation, we cover tools every Canadian investor needs.

How to Build a Winning Tax Sale Watchlist: Strategies for Canadian Investors

Unlock the secrets to creating a strategic tax sale watchlist in Canada. Learn expert tips, avoid common pitfalls, and discover how to track opportunities effectively.

Agricultural Tax Sale Properties: Navigating Supply Management and Land Use Restrictions

Explore the complexities of investing in agricultural tax sale properties in Canada, with insights on supply management and land use restrictions.

How a $8,000 Tax Sale Lot Transformed into a $350,000 Home Investment

Discover how a savvy investor turned an overlooked $8,000 tax sale property into a stunning $350,000 home. Learn key strategies and pitfalls in this remarkable transformation story.

How One Investor Transformed a Tax Sale Property into a Lucrative Short-Term Rental

Explore the process of turning tax sale properties into profitable short-term rentals, navigating Canadian regulations, and maximizing revenue.

Navigating Insurance Costs for Tax Sale Properties: Strategies to Save in Canada

Discover crucial insights into managing insurance costs for tax sale properties in Canada, featuring real-world strategies to maximize savings and avoid common pitfalls.

The Essential Documents You Need to Bid at a Canadian Tax Sale

Discover the critical paperwork required to bid at municipal tax sales in Canada, ensuring compliance with local regulations and maximizing investment opportunities.

Exploring Tax Sale Properties in Canada’s Wine Regions: Niagara & Okanagan Insights

Explore tax sale opportunities in Canada's wine regions like Niagara and Okanagan. Discover regulations, investment strategies, and pitfalls to avoid.

The Impact of Rising Interest Rates on Canada's Tax Sale Market in 2024

Discover how rising interest rates are transforming Canada's tax sale landscape, affecting property values and investment strategies. Learn actionable tips to navigate this changing market.

Inflation's Impact on Tax Sale Investing: Safe Haven or Risky Business?

Explore whether Canadian tax sale properties remain a safe investment during inflation. Understand risks, regulations, and strategies for success.

Homesteading on a Budget: Unlocking Tax Sale Properties for Self-Sufficiency in Canada

Discover how Canadian tax sale properties can be the key to affordable homesteading. Learn the ins and outs of investing in tax sales for a self-sufficient lifestyle.

Choosing Between Corporate and Personal Purchases for Tax Sales: A Canadian Guide

Explore the benefits and drawbacks of buying tax sale properties under a corporation versus personal name with real-world examples and expert tips.